In 2021, a small Central American nation embarked on a groundbreaking financial experiment. It became the first country worldwide to adopt cryptocurrency as legal tender. This historic decision by El Salvador marked a dramatic shift in how governments approach digital currencies in the modern economy.

President Nayib Bukele championed this bold initiative with promises of economic transformation. His administration promoted the digital currency as a solution to banking challenges faced by many citizens. They also saw it as a magnet for foreign investment and innovation.

The move sparked intense global attention. Financial experts, tech enthusiasts, and government officials worldwide watched closely as this unprecedented monetary policy unfolded. Some praised the forward-thinking approach, while others expressed serious concerns about volatility risks and implementation challenges.

This pioneering step represents more than just a new payment method. It signals a potential shift in how nations might approach currency sovereignty in the digital age. The outcomes of this initiative could influence how other countries view cryptocurrency integration into their financial systems.

Key Takeaways

- El Salvador made history as the first nation to grant cryptocurrency legal tender status in 2021

- President Bukele’s initiative aimed to improve banking access and attract foreign investment

- The Legislative Assembly officially approved the digital currency adoption

- The move generated mixed reactions from domestic and international stakeholders

- This financial experiment represents a significant test case for cryptocurrency in national economies

- The outcomes may influence how other countries approach digital currency adoption

El Salvador’s Bitcoin Journey: The Bold Economic Experiment

El Salvador made history by becoming the first nation to adopt Bitcoin as official legal tender. This groundbreaking move, announced in June 2021, shook the global financial scene. It placed the small Central American country at the vanguard of cryptocurrency adoption.

A First in Global Finance

El Salvador’s decision to adopt Bitcoin challenges traditional monetary systems. For the first time, a decentralized digital currency, Bitcoin, gained equal legal status with a major fiat currency—the US dollar.

This bold step diverged from centuries of central banking principles. While other nations explored blockchain and digital currencies, none had made a cryptocurrency an official legal tender.

The implications of this move are far-reaching. It created a real-world test for Bitcoin’s viability as a national currency. This was a concept previously discussed by economists and crypto enthusiasts.

President Bukele’s Vision

At the core of this financial shift is President Nayib Bukele. His tech-savvy governance has defined his administration. On June 5, 2021, Bukele surprised the Bitcoin Conference in Miami with an English-language video. He announced his plan to make Bitcoin legal tender.

Bukele’s economic vision aimed to achieve several key objectives. He believed Bitcoin could help:

| Goal | Traditional Approach | Bitcoin Solution |

|---|---|---|

| Remittance Costs | High fees from wire transfers and services | Lower-cost digital transfers |

| Financial Inclusion | Limited banking access for many citizens | Digital wallets accessible to anyone with a smartphone |

| Foreign Investment | Traditional economic incentives | Attraction of crypto entrepreneurs and investors |

| Economic Innovation | Following established financial models | Positioning as a hub for financial technology |

“We must break the paradigms of the past,” Bukele stated. “Bitcoin will help reduce our dependence on the US dollar and create new opportunities for our people.”

The president’s personal interest in cryptocurrency drove his bold approach. He chose full adoption over gradual integration. Bukele believed this would give El Salvador a first-mover advantage, benefiting its developing economy and large unbanked population.

Historical Context of El Salvador’s Economy

To grasp El Salvador’s bold Bitcoin move, we must look at its economic history. This small Central American nation’s economic journey is marked by challenges and adaptations. These experiences set the stage for its cryptocurrency adoption.

Pre-Bitcoin Economic Challenges

El Salvador’s economic story starts with the devastating civil war from 1979 to 1992. This 13-year conflict severely damaged the economy, destroying infrastructure and displacing nearly a quarter of the population.

After the war, El Salvador faced persistent poverty and inequality. Despite market reforms in the 1990s, growth was slow and uneven. High crime rates also deterred investment and hindered development.

Dollarization and Its Effects

El Salvador made a significant monetary shift by abandoning the colón (SVC) on January 1, 2001. The Monetary Integration Act, passed under President Francisco Flores, allowed the US dollar to circulate freely, removing the colón.

The goals of dollarization were financial stability, attracting foreign investment, and reducing trade costs. Yet, it came with significant costs.

Dollarization eliminated El Salvador’s ability to implement independent monetary policy, leaving it vulnerable to economic shocks and limiting crisis response options.

This move meant El Salvador could no longer adjust its currency value to stay competitive or meet domestic economic needs. It became entirely dependent on US Federal Reserve decisions, despite its different economic conditions.

Remittance Dependency

El Salvador’s pre-Bitcoin economy was heavily reliant on remittances. In 2020, money sent home by Salvadorans abroad accounted for 23% of the country’s GDP.

This reliance created unique challenges. Traditional money transfer services charged high fees, sometimes taking 10-20% of the funds. For many families, these costs were a significant burden.

The remittance dependency also made El Salvador’s economy vulnerable to external shocks, as seen during the COVID-19 pandemic when remittance flows decreased. President Bukele cited this vulnerability as a reason for Bitcoin adoption, aiming to reduce remittance costs and increase financial sovereignty.

The Bitcoin Law: Legislative Framework

On June 9, 2021, El Salvador made history by passing the Bitcoin Law. This law established the first legislative framework to recognize a cryptocurrency as legal tender. The Legislative Assembly approved the law with a decisive majority of 62 votes out of 84 deputies. This groundbreaking cryptocurrency legislation was proposed and enacted with remarkable speed, reflecting President Bukele’s decisive governance approach.

Key Provisions of the Law

The Bitcoin Law in El Salvador contains several revolutionary provisions. It officially recognizes Bitcoin as legal tender alongside the US dollar. This gives it equal status for all financial transactions within the country.

The law exempts Bitcoin transactions from capital gains tax. This removes a significant barrier to everyday cryptocurrency use. It also offers permanent residency to foreign investors who contribute at least 3 Bitcoin to the Salvadoran economy. This creates an innovative pathway to attract international investment.

Legal Status of Bitcoin in El Salvador

Unlike other nations, El Salvador grants Bitcoin full legal status as currency. This means government agencies must accept it for tax payments. Accounting systems throughout the country needed adaptation to handle dual-currency operations.

The law establishes a legal framework for Bitcoin’s use in contracts, debt settlements, and public obligations. This comprehensive legal recognition goes far beyond the limited regulatory approaches seen in other countries.

Mandatory Acceptance Requirements

Perhaps the most controversial aspect of the legislation is its mandatory Bitcoin acceptance provision. The law requires all businesses and merchants to accept Bitcoin as payment for goods and services if they have the technological capability to do so.

The government recognized implementation challenges by including exceptions for those without access to necessary technology. The mandatory nature of acceptance sparked significant debate about business autonomy and practical implementation hurdles in areas with limited technological infrastructure.

Implementation Timeline of El Salvador Bitcoin

El Salvador’s adoption of Bitcoin was swift, marking a significant shift in national monetary policy. The government’s plan, from announcement to law, took just three months. This rapid pace brought both excitement and challenges as the country prepared for this monetary change.

Announcement to Adoption

President Nayib Bukele stunned the world on June 5, 2021, by announcing Bitcoin as legal tender in El Salvador at the Bitcoin 2021 conference in Miami. This bold move initiated a fast-paced implementation process. Only three days later, on June 8, the Bitcoin Law was presented to the Legislative Assembly.

The law’s approval came swiftly, with 62 votes in favor and 19 against on June 9, 2021. President Bukele signed it into law shortly after, setting September 7, 2021, as the implementation date. This 90-day timeline from announcement to nationwide adoption was one of the quickest in modern history.

The tight schedule left little room for public consultation or gradual implementation. Instead, the government adopted a “big bang” approach, making Bitcoin legal tender nationwide at once. This bold strategy reflected President Bukele’s decisive leadership but posed significant challenges.

Key Milestones

El Salvador’s Bitcoin adoption was marked by several key milestones. After legislative approval, the government quickly started developing the necessary infrastructure for cryptocurrency use. By late June 2021, the “Chivo Wallet,” a digital wallet application, was announced.

In July and August 2021, hundreds of Bitcoin ATMs were installed across the country. These ATMs were placed in public areas to facilitate Bitcoin-to-dollar conversions. The government also launched an educational campaign to teach citizens about cryptocurrency and the Chivo wallet.

The weeks leading up to the September 7 launch were filled with intense activity. Government agencies conducted training sessions for businesses, set up customer support centers, and finalized technical systems. On September 6, the government bought its first 400 Bitcoin, worth about $20 million, showing its commitment to the new system.

Government Preparation Efforts

El Salvador’s government made significant preparations for Bitcoin implementation. A $150 million Bitcoin Trust was created to ensure the convertibility of Bitcoin to U.S. dollars. This fund aimed to mitigate the risks associated with cryptocurrency volatility.

Building the technical infrastructure was a priority. The government collaborated with technology providers to develop the Chivo wallet platform, establish secure transaction systems, and create service points for citizen assistance.

Despite these efforts, challenges were significant. The World Bank declined to assist due to environmental and transparency concerns. This forced El Salvador to rely more on private sector partners and internal resources. Technical issues also plagued the Chivo wallet during its launch, with users facing problems creating accounts or completing transactions.

| Date | Event | Significance | Challenges |

|---|---|---|---|

| June 5, 2021 | Initial announcement at Bitcoin Conference | First public declaration of Bitcoin plans | Surprise announcement with limited preparation |

| June 9, 2021 | Bitcoin Law approved by legislature | Legal framework established | Limited debate and public consultation |

| July-August 2021 | Infrastructure development period | Creation of Chivo wallet and ATM network | Compressed development timeline |

| September 6, 2021 | First government Bitcoin purchase (400 BTC) | Commitment to cryptocurrency reserves | Exposure to market volatility |

| September 7, 2021 | Official implementation date | Bitcoin becomes legal tender nationwide | Technical issues with Chivo wallet launch |

The rapid Bitcoin implementation timeline showcased both the government’s determination and its challenges. While the speed demonstrated decisive leadership, it also limited opportunities for thorough testing, public education, and infrastructure development. This compressed schedule would impact many of the adoption issues that emerged after the official launch date.

The Chivo Wallet Initiative

The Chivo wallet is at the core of El Salvador’s cryptocurrency journey. It’s a digital wallet backed by the government, aiming to make Bitcoin accessible to everyone. This wallet is key to the country’s Bitcoin law, enabling transactions in both dollars and Bitcoin. The launch of the Chivo wallet sparked both excitement and skepticism, marking a significant step in El Salvador’s financial evolution.

Development and Rollout

The government teamed up with private companies to create the Chivo wallet. Details about these partnerships are still under wraps. President Bukele announced the wallet’s development in June 2021, aiming for a September launch to coincide with Bitcoin’s legal status.

The rollout in October 2021 was marred by technical issues. Users faced server outages, verification problems, and transaction failures. The government worked to fix these problems while keeping public trust intact.

There were concerns about the lack of transparency in the wallet’s development. The government kept much of this information secret, making it hard for experts to assess the wallet’s security and management.

Technical Specifications

The Chivo wallet allows users to switch between Bitcoin and US dollar transactions easily. This feature was designed to help citizens get used to cryptocurrency while keeping the dollar economy intact.

The app uses Lightning Network technology for fast and cheap Bitcoin transactions. This was crucial for everyday purchases, as traditional Bitcoin transactions were too slow and expensive for small payments.

It also has features like QR code scanning for payments, instant currency conversion, and integration with the financial system for remittances.

User Experience and Adoption Rates

Initial download numbers looked promising, with over 3 million downloads in the first few months. Yet, research showed many downloaded it just for the free Bitcoin, with little ongoing use.

The app’s user interface got mixed reviews. It was meant to be easy for beginners, but many found it confusing. Technical issues made things worse, with users reporting missing funds and failed transactions.

By early 2022, usage had dropped significantly. A survey by the Chamber of Commerce found only 14% of businesses used Chivo for Bitcoin transactions, despite the legal requirement.

Initial $30 Bitcoin Incentive

The government offered a $30 Bitcoin incentive for each citizen who downloaded and registered with Chivo. This program cost up to $75 million, a big investment to boost adoption.

The incentive did drive initial downloads but didn’t lead to sustained use. Many Salvadorans quickly converted the Bitcoin to dollars, seeing it as a one-time government gift rather than a gateway to cryptocurrency.

| Chivo Wallet Metric | Initial Phase (2021) | Six Months Later | Current Status |

|---|---|---|---|

| Downloads | 3+ million | Minimal new growth | Stagnant |

| Active Users | High (incentive-driven) | Sharp decline | Low ongoing usage |

| Technical Issues | Numerous and severe | Partially resolved | Occasional problems |

| User Satisfaction | Mixed | Declining | Low among general population |

The cryptocurrency incentive program showed both the promise and challenges of government-backed digital currency adoption. It sparked immediate interest but highlighted the need for more than just financial incentives to overcome technical hurdles and user skepticism in adopting new financial technologies.

Financial Inclusion Impact via Bitcoin

Financial inclusion became a key reason for El Salvador’s Bitcoin law. It aimed to bridge the banking gap, ensuring all citizens could access financial services. This move was seen as a way to provide digital financial access, regardless of economic status or location.

Banking the Unbanked

Before Bitcoin, 70% of El Salvador’s population was unbanked. This group faced challenges like not being able to save securely or get credit. They relied heavily on cash.

The Bitcoin initiative aimed to bypass traditional banking’s limitations. By 2022, more Salvadorans had Bitcoin wallets than bank accounts. This showed cryptocurrency’s potential to reach the unbanked.

Access to Financial Services

The Chivo wallet opened doors to digital financial services for many. Users could receive remittances without high fees, make digital payments, and store value electronically. They didn’t need traditional banking.

In places like El Zonte (Bitcoin Beach), people started using Bitcoin on mobile devices and ATMs. This was a big change for many.

Digital Literacy Challenges

Despite the promise, challenges arose. Elderly citizens and those in rural areas found it hard to use cryptocurrency.

They lacked smartphones, had poor internet, and didn’t know how to use digital wallets. Educational efforts by the government were not enough to overcome these digital literacy challenges. This left some unable to use the new financial system.

Success Stories and Failures

The results of Bitcoin adoption were mixed. In places like El Zonte, businesses and individuals used it for daily transactions. Some entrepreneurs even accessed international markets.

But, many left the Chivo wallet after the initial $30 bonus. Technical issues, identity problems, and security concerns eroded trust. For many vulnerable Salvadorans, Bitcoin’s promise of financial inclusion remains unfulfilled.

Bitcoin City and Volcano Bonds

El Salvador’s cryptocurrency experiment takes a bold leap forward with the conceptualization of Bitcoin City and innovative Volcano Bonds. These ambitious initiatives represent President Bukele’s long-term vision for transforming the nation into a global cryptocurrency hub. This vision extends far beyond the initial adoption of Bitcoin as legal tender.

The Ambitious Urban Project

In November 2021, President Bukele unveiled plans for Bitcoin City, a futuristic urban development designed in a circular shape at the base of the Conchagua volcano. This tax haven would eliminate income taxes entirely, attracting international investors and crypto enthusiasts.

The proposed metropolis aims to become a fully functioning city with residential areas, commercial zones, restaurants, and an airport. At its center would stand a plaza designed to resemble the Bitcoin symbol when viewed from above, symbolizing the city’s foundational purpose.

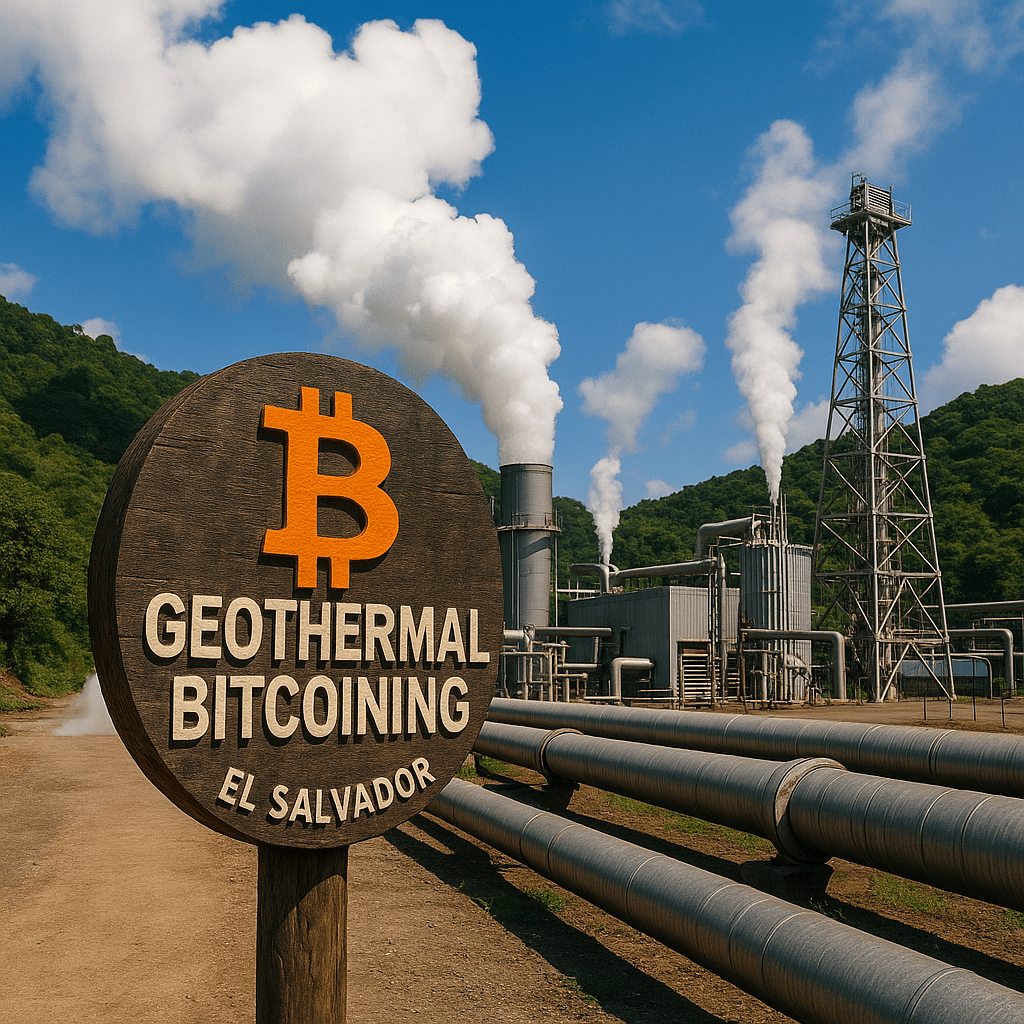

Geothermal Mining Operations

One of the most innovative aspects of the Bitcoin City plan is its proposed use of geothermal Bitcoin mining. The Conchagua volcano would provide clean, renewable energy to power mining operations, addressing one of the most common criticisms of cryptocurrency – its environmental impact.

El Salvador’s volcanic landscape offers abundant geothermal resources, with the country already generating about 25% of its electricity from geothermal plants. This natural advantage positions El Salvador to potentially become a leader in sustainable cryptocurrency mining.

Financing Through Volcano Bonds

To fund this ambitious project, the Salvadoran government announced plans to issue $1 billion in what they’ve dubbed “Volcano Bonds.” Half of the proceeds would finance Bitcoin City’s infrastructure development, while the remaining $500 million would be invested directly in Bitcoin with a five-year lock-up period.

These tokenized bonds would offer investors a unique opportunity to participate in both El Salvador’s urban development and its cryptocurrency strategy. The government proposed a 6.5% yield for bond investors, with additional potential returns from Bitcoin appreciation after the lock-up period.

Current Status of Development

Despite the initial enthusiasm, both Bitcoin City and the Volcano Bonds have faced significant delays. The bonds, originally scheduled for issuance in early 2022, have been postponed multiple times due to unfavorable market conditions and cryptocurrency volatility.

As of now, Bitcoin City remains largely conceptual, with minimal physical development at the proposed site. The government continues to refine the legislative framework needed to issue the Volcano Bonds, demonstrating the practical challenges of implementing such revolutionary financial and urban development projects.

These ambitious initiatives highlight both the innovative vision driving El Salvador’s Bitcoin strategy and the real-world obstacles faced when attempting to build an economy around a volatile digital asset.

Public Response to Bitcoin Adoption

El Salvador’s Bitcoin experiment has sparked a mix of opinions. The government’s bold step has drawn both supporters and detractors. This has created a complex landscape of acceptance, resistance, and confusion.

Citizen Reactions

Most Salvadorans have shown skepticism towards Bitcoin. A September 2021 poll by the Central American University found that 9 out of 10 citizens were unclear about Bitcoin. This skepticism deepened as 68% of respondents disagreed with making it legal tender.

Trust in traditional currency remained strong despite government efforts. By November 2021, a Centro de Estudios Ciudadanos poll showed that 91% of Salvadorans preferred US dollars over Bitcoin for daily transactions.

Business Adaptation

The business community faced significant challenges with Bitcoin adoption. Small merchants struggled with the need for reliable internet and compatible devices to process cryptocurrency payments.

“We want to serve our customers, but many of us don’t understand how Bitcoin works or how to manage its volatility. The government gave us little time to prepare,” explained a San Salvador restaurant owner.

Larger businesses adapted more quickly. Multinationals like Starbucks and McDonald’s started accepting Bitcoin payments. Yet, compliance varied widely across sectors and regions.

Protests and Support

The Bitcoin rollout led to significant protests. On September 7, 2021, thousands gathered in San Salvador to oppose the Chivo wallet and Bitcoin adoption. They expressed concerns about economic stability and government overreach.

Younger, tech-savvy Salvadorans were more supportive. Communities like El Zonte, known as “Bitcoin Beach,” showed greater enthusiasm and adoption rates.

Adoption Metrics

Initial Chivo wallet downloads were promising, with over 3 million downloads in a country of 6.5 million. Yet, usage patterns showed a different reality. Many downloaded the app for the $30 Bitcoin incentive before abandoning it.

Transaction data revealed Bitcoin’s limited role in the country’s economy. US dollars remained the dominant medium of exchange for most transactions.

International Reactions

El Salvador’s Bitcoin experiment drew a wide range of reactions. Traditional financial institutions issued stern warnings, while crypto enthusiasts showed enthusiastic support. This move to adopt a cryptocurrency as legal tender sent shockwaves through the global financial system. It forced institutions and nations to take official stances on this monetary innovation.

IMF and World Bank Stance

The International Monetary Fund (IMF) was a vocal critic of El Salvador’s Bitcoin law. In January 2022, it explicitly urged El Salvador to reverse its Bitcoin adoption. The IMF cited significant concerns about financial stability, consumer protection, and fiscal responsibility.

The IMF’s stance had a significant impact on El Salvador’s access to traditional financing. Officials stated that continued use of Bitcoin would likely jeopardize a $1.3 billion loan package the country sought.

The World Bank also rejected El Salvador’s request for technical assistance in implementing the Bitcoin law. Their refusal was due to concerns about Bitcoin’s environmental impact and transparency issues in the implementation process.

Other Nations’ Responses

The international community showed varied reactions to El Salvador’s bold move. Several Latin American countries, including Paraguay, Panama, and Argentina, expressed interest in exploring similar cryptocurrency initiatives. They approached these initiatives with caution, though.

In contrast, economic powerhouses like the United States, China, and the European Union maintained skeptical positions. They viewed the experiment as risky and potentially destabilizing to traditional financial systems.

Cryptocurrency Community Feedback

The global cryptocurrency community rallied behind El Salvador with overwhelming support. Bitcoin advocates celebrated the adoption as a historic milestone for cryptocurrency legitimacy and a powerful real-world use case.

Crypto influencers and blockchain companies offered technical expertise and resources to help ensure the success of the initiative. Many prominent figures in the space made highly publicized visits to El Salvador, further amplifying international attention on the experiment.

Credit Rating Implications

The financial consequences of Bitcoin adoption became evident when Moody’s Investors Service downgraded El Salvador’s credit rating in July 2021. The rating agency cited President Bukele’s fiscal policies and Bitcoin adoption as contributing factors to increased sovereign risk.

| Entity | Stance on El Salvador’s Bitcoin Law | Primary Concerns | Actions Taken |

|---|---|---|---|

| IMF | Strongly Negative | Financial stability, consumer protection | Withheld $1.3B loan consideration |

| World Bank | Negative | Environmental impact, transparency | Rejected implementation assistance |

| Moody’s | Negative | Fiscal risk, economic stability | Downgraded sovereign credit rating |

| Cryptocurrency Community | Highly Positive | Adoption speed, technical infrastructure | Provided technical support, investment |

These international reactions highlighted the tension between traditional financial systems and emerging cryptocurrency innovations. While established institutions raised legitimate concerns about stability and risk, the cryptocurrency community saw El Salvador’s experiment as a necessary step toward financial evolution and sovereignty.

Economic Impact Assessment

El Salvador’s Bitcoin adoption has shown both successes and setbacks. Since the Bitcoin Law was introduced in September 2021, the country has seen changes in various sectors. These changes offer insights into whether the cryptocurrency experiment is meeting its expected outcomes.

Tourism and Investment Changes

“Crypto tourism” has become a notable economic effect of Bitcoin adoption. El Zonte, known as “Bitcoin Beach,” has seen a 30% increase in business from Bitcoin enthusiasts and curious travelers. These tourists spend more than traditional visitors, boosting local economies.

Yet, this tourism boost is mainly seen in specific areas, not across the whole country. Investment patterns also show mixed results. Some blockchain companies have set up in El Salvador, but traditional foreign investment remains cautious due to regulatory issues.

Remittance Transformation

One main reason for adopting Bitcoin was to lower remittance costs. Remittances make up about 20% of El Salvador’s GDP. Despite the government’s goals, Bitcoin’s use for remittances has been limited. The Central Reserve Bank reports Bitcoin was used in 1.9% of remittance payments from September 2021 to April 2022.

Traditional money transfer services still dominate the market. Yet, those using Bitcoin for remittances have saved on fees. The gap between what was hoped for and what has happened shows the challenges of changing financial behaviors, even with potential benefits.

GDP and Economic Indicators

El Salvador’s economy has grown significantly since adopting Bitcoin, with a 19% GDP increase between 2021 and 2023. This growth is faster than before 2019. Economists, though, debate how much of this growth is due to Bitcoin versus other factors like the post-pandemic recovery.

Inflation has been controlled, and foreign reserves have stabilized, despite initial concerns about Bitcoin’s volatility. The following table shows key economic indicators before and after Bitcoin adoption:

| Economic Indicator | Pre-Bitcoin (2019-2020) | Post-Bitcoin (2021-2023) | Change |

|---|---|---|---|

| GDP Growth Rate | -8.1% (2020) | 19% (cumulative) | Significant improvement |

| Tourism Revenue | $800 million | $1.2 billion | 50% increase |

| Remittance Costs | 6.5% average fee | 6.3% average fee | Minimal reduction |

| Foreign Investment | $200 million | $260 million | 30% increase |

Employment Effects

Bitcoin has created jobs in tech, customer service, and financial education. The Chivo wallet needed hundreds of staff and technical experts. New Bitcoin-focused businesses have also emerged, mainly in tourism areas.

Yet, these gains need to be seen in context. Only 14% of businesses conducted Bitcoin transactions between September 2021 and July 2022. Only 3% reported Bitcoin acceptance as beneficial. This shows Bitcoin’s limited impact on the broader economy and workforce.

“Bitcoin has created a new economic niche in El Salvador, but its benefits remain unevenly distributed across our society and business sectors,” notes a 2023 report from the Salvadoran Economic Institute.

The overall economic impact assessment shows Bitcoin adoption has brought some benefits, like tourism growth and specific sector increases. Yet, it has not transformed El Salvador’s economy as much as was hoped. The experiment continues, with both positive signs and ongoing challenges shaping its future.

Technical Challenges and Solutions

El Salvador’s adoption of Bitcoin as legal tender unveiled a complex array of technical challenges. The nation, pioneering in cryptocurrency adoption, encountered unprecedented obstacles. These hurdles were aimed at establishing a digital payment system accessible to all citizens.

Infrastructure Limitations

El Salvador’s limited internet access posed a primary obstacle to Bitcoin adoption. Only 50.5% of Salvadorans had reliable internet when Bitcoin was introduced. This created a significant barrier for nearly half the population.

Electricity unreliability, common in rural areas, further complicated matters. These fundamental infrastructure gaps hindered consistent access to the digital currency system. Many citizens found it challenging to participate, even if they wanted to.

Lightning Network Implementation

To overcome Bitcoin’s transaction speed limitations, El Salvador adopted the Lightning Network. This second-layer solution, built on the Bitcoin blockchain, enables faster, cheaper transactions. It processes transactions off the main blockchain, enhancing usability.

The Lightning Network was crucial for making Bitcoin practical for everyday purchases. Without it, transaction fees and confirmation times would have made small purchases impractical.

Security Concerns

The Chivo wallet rollout exposed significant security vulnerabilities. The system was disabled within hours to increase server capacity due to overwhelming user registrations.

Identity theft became a serious issue, with fraudsters using stolen IDs to claim the $30 Bitcoin signup bonus. This highlighted weaknesses in the verification system and eroded public trust in the platform.

Offline Transaction Solutions

Developers created innovative offline transaction methods to address connectivity issues. SMS-based Bitcoin transfers were developed for basic mobile phones without internet access.

Businesses also implemented paper-based QR code systems for storing transaction data. These systems allowed for later processing when internet access was available. Such creative solutions extended Bitcoin access to areas with limited technological infrastructure.

| Technical Challenge | Solution Implemented | Effectiveness |

|---|---|---|

| Slow transaction speeds | Lightning Network integration | High – reduced transaction times from hours to seconds |

| Limited internet access | SMS-based transactions | Moderate – helped reach rural areas but adoption remained low |

| Identity verification issues | Enhanced biometric controls | Mixed – reduced fraud but created new barriers for some users |

| Server capacity limitations | Infrastructure scaling | Improved – initial outages resolved but occasional issues persist |

Bitcoin Price Volatility Effects

El Salvador’s bold move to adopt Bitcoin as legal tender has brought forth a significant challenge: managing its extreme price swings. Since embracing Bitcoin, the government has grappled with its notorious volatility. Prices have fluctuated wildly, necessitating innovative strategies to safeguard national finances while upholding the Bitcoin vision.

Treasury Management Strategies

El Salvador has crafted unique treasury management approaches to tackle Bitcoin’s unpredictable nature. Instead of converting Bitcoin to dollars immediately, the government has adopted a “HODL” strategy. This reflects President Bukele’s faith in Bitcoin’s long-term value.

The treasury employs a dual-track system, balancing dollar reserves for immediate needs with Bitcoin as a strategic investment. This strategy aims to stabilize the economy while capitalizing on potential cryptocurrency gains.

Impact on National Reserves

Bitcoin’s volatility has had a significant impact on El Salvador’s national reserves. By mid-2022, the government’s Bitcoin investments had lost about 50% of their value. This loss equated to roughly 4% of the country’s reserves, with Bukele investing around US$150 million.

By December 2023, the government’s Bitcoin holdings had rebounded, gaining US$3.7 million in value. By March 2024, El Salvador’s Bitcoin gamble had yielded a 50% profit, with Bitcoin reaching a new all-time high over $69,000.

Hedging Mechanisms

To counter volatility risks, El Salvador has explored various hedging mechanisms. The country maintains significant dollar reserves alongside Bitcoin and times government operations for favorable market conditions. It has also developed contingency plans for extreme market downturns.

Financial experts suggest using Bitcoin derivatives or stablecoins as additional hedging tools. Yet, the government has generally opted for a straightforward holding strategy over complex financial instruments.

Government Bitcoin Purchases

President Bukele has famously announced government Bitcoin purchases on social media, often using a “buy the dip” strategy. The first purchase was on September 6, 2021, acquiring ₿400 worth approximately $20.9 million.

By 2022, the government had amassed around 2,300 bitcoins through strategic purchases. Bukele’s public announcements have been both praised for transparency and criticized for potentially influencing market prices. The government’s strategy mirrors dollar-cost averaging, buying more Bitcoin during price declines.

Despite initial skepticism, El Salvador’s Bitcoin holdings have shown resilience through market cycles. The treasury’s strategies offer valuable lessons for other nations contemplating cryptocurrency adoption.

Regulatory and Compliance Issues

The regulatory landscape for El Salvador’s Bitcoin adoption is complex, blending international financial standards with compliance expectations. As the first nation to make Bitcoin legal tender, El Salvador is a testing ground for cryptocurrency regulation. This has raised questions about financial oversight, both domestically and internationally.

Anti-Money Laundering Considerations

Significant concerns about Bitcoin’s potential for illicit activities in El Salvador have been raised. The anonymous nature of blockchain transactions has led to warnings about money laundering, tax evasion, and financing criminal organizations.

El Salvador’s history with transnational gangs and human trafficking has heightened these concerns. Experts have warned that cryptocurrency misuse could occur within El Salvador’s criminal ecosystems without proper safeguards.

International Regulatory Pressure

El Salvador has faced significant pressure from global financial institutions since announcing its Bitcoin initiative. The International Monetary Fund has expressed concerns about macroeconomic risks and regulatory challenges.

The Financial Action Task Force (FATF) has closely monitored El Salvador’s implementation of global standards for combating money laundering. The United States and neighboring countries have also applied diplomatic pressure, citing potential regulatory arbitrage risks to regional financial stability.

Compliance Solutions

El Salvador has implemented several compliance mechanisms in response to these pressures. The Chivo wallet requires Know-Your-Customer (KYC) verification, including identity validation through national ID cards and biometric verification.

The government has also established monitoring systems to flag suspicious transaction patterns. These systems aim to balance Bitcoin’s pseudonymous nature with necessary regulatory oversight.

Transparency Measures

Transparency regarding government Bitcoin holdings is a contentious issue. While President Bukele has occasionally announced Bitcoin purchases on Twitter, critics argue there’s a lack of formal, auditable disclosures about the national Bitcoin treasury.

The Salvadoran government has promised future transparency frameworks to address these concerns. Yet, international organizations continue to advocate for more comprehensive disclosure mechanisms that align with global financial reporting standards.

Despite challenges, El Salvador’s approach to cryptocurrency regulation is seen as a potential blueprint for other nations. The success or failure of its regulatory solutions will likely shape future cryptocurrency governance frameworks worldwide.

Lessons for Other Nations

El Salvador’s bold move to adopt Bitcoin as legal tender has turned into a real-world lab for other governments. This experiment is closely watched by policymakers, economists, and financial experts. They aim to learn what strategies might work in their own countries. El Salvador’s journey offers both lessons and warnings for nations thinking about cryptocurrency.

Transferable Success Elements

Several aspects of El Salvador’s strategy show promise for other countries. The development of a user-friendly digital wallet, like the Chivo wallet, is a standout innovation. It was designed to be accessible to citizens with little technical knowledge, offering a model for others.

The initial Bitcoin incentive program also showed its worth. By giving citizens $30 in Bitcoin, El Salvador encouraged early adoption. Financial incentives can significantly accelerate cryptocurrency adoption, helping populations new to digital assets.

Another success is integrating Bitcoin with existing payment systems. El Salvador built bridges between Bitcoin and traditional payment methods. This approach allowed for a gradual transition, avoiding disruptive changes.

Cautionary Aspects

El Salvador’s experience also highlights challenges to consider. Price volatility is a major concern for any nation adopting Bitcoin. When the cryptocurrency’s value dropped sharply in 2022, it hit El Salvador’s national reserves hard, causing economic uncertainty.

Technical implementation difficulties were another hurdle. The Chivo wallet launch faced server crashes and identity verification problems. Countries with less robust technical infrastructure would likely face even greater challenges.

Conflicts with international financial institutions were another warning. The IMF and World Bank expressed significant concerns, affecting El Salvador’s credit rating and access to traditional financing. Nations considering similar policies should anticipate potential friction with global financial governance bodies.

Adaptation Requirements

Countries evaluating cryptocurrency adoption must assess their readiness. Internet penetration is a fundamental prerequisite, as digital currency usage requires reliable online access. Nations with limited connectivity would need significant infrastructure investment before implementation.

Digital literacy levels among the population directly impact adoption success. El Salvador’s experience showed that even with user-friendly interfaces, many citizens struggled to understand and trust the new system. Educational campaigns and technical support networks proved essential but still insufficient in some communities.

Existing financial infrastructure strength determines how cryptocurrency might complement or replace traditional systems. Countries with underdeveloped banking but strong mobile payment adoption (like some African nations) might find different implementation paths more suitable than those modeled by El Salvador.

Alternative Implementation Models

Several alternative approaches could offer more suitable paths for different economic contexts. A gradual introduction strategy might begin with cryptocurrency as an optional payment method before any consideration of legal tender status. This approach reduces risk while allowing systems and public understanding to develop organically.

Opt-in rather than mandatory acceptance provides another alternative model. While El Salvador initially required all businesses to accept Bitcoin, this proved challenging to enforce and created resistance. An optional framework might generate less opposition while still encouraging adoption.

The use of stablecoins instead of volatile cryptocurrencies could address one of the most significant challenges in El Salvador’s approach. Currencies pegged to established fiat money might offer digital benefits while minimizing price fluctuation risks.

| Implementation Model | Key Features | Potential Benefits | Potential Challenges |

|---|---|---|---|

| Full Legal Tender (El Salvador Model) | Mandatory acceptance, government wallet, Bitcoin reserves | Maximum disruption potential, complete ecosystem | High volatility risk, international resistance, technical complexity |

| Gradual Introduction | Phased implementation, optional early stages | Reduced implementation shock, time for adaptation | Slower adoption rates, fragmented usage |

| Opt-In Framework | Voluntary participation, incentive-driven | Lower resistance, market-driven growth | Potential for limited network effects |

| Stablecoin Approach | Price-stable digital currencies, reduced volatility | Price stability, easier accounting, reduced risk | Centralization concerns, regulatory complexity |

Following El Salvador’s lead, the Central African Republic became the second nation to adopt Bitcoin as legal tender in April 2022. Their implementation differed significantly due to lower internet penetration and digital literacy rates. Panama proposed a modified approach through congressman Gabriel Silva’s bill, which focused on regulatory clarity rather than mandatory acceptance.

As digital currency policy continues to evolve globally, El Salvador’s experiment provides invaluable data for cryptocurrency national implementation strategies. The most successful approaches will likely be those tailored to each country’s unique economic conditions, technical capabilities, and policy objectives rather than direct replications of the El Salvador model.

Conclusion: The Future of El Salvador’s Bitcoin Experiment

El Salvador’s bold step into the digital currency world has seen significant changes since 2021. The data shows a sharp drop in Bitcoin usage among locals. From 25.7% in 2021, it plummeted to 8.1% in 2024. This decline highlights the practical hurdles of adopting such a groundbreaking financial system.

The December 2024 deal with the IMF for a $1.4 billion loan is a pivotal moment. El Salvador agreed to scale back several Bitcoin initiatives. This includes reducing government Bitcoin purchases and ending mandatory merchant acceptance. It also involves stopping Bitcoin tax payments and reducing Chivo wallet involvement.

These policy adjustments indicate a shift towards a more practical approach. President Bukele’s administration must now navigate between cryptocurrency dreams and economic stability. They must also consider international financial cooperation.

Despite the challenges, El Salvador’s move has changed the global conversation on national cryptocurrency adoption. Other countries are learning from this experiment. They gain insights into the benefits and drawbacks of integrating digital assets into traditional economies.

El Salvador’s Bitcoin experiment, whether it succeeds or not, has etched its place in financial history. It was the first nation to adopt Bitcoin as legal tender. This has provided a real-world test for ideas previously theoretical. It sets a precedent for cryptocurrency policy discussions globally for years to come.

FAQs

When did El Salvador adopt Bitcoin as legal tender?

El Salvador adopted Bitcoin as legal tender on September 7, 2021. This followed President Nayib Bukele’s announcement at the Bitcoin Conference in Miami in June 2021. It made El Salvador the first sovereign nation to recognize a cryptocurrency as legal tender, alongside the US dollar.

Why did El Salvador decide to adopt Bitcoin?

President Bukele cited several reasons for adopting Bitcoin. These included reducing remittance costs, banking the unbanked, and attracting foreign investment. He also aimed to position El Salvador as a financial innovation hub. The government saw it as a way to gain more monetary sovereignty while maintaining dollarization’s stability benefits.

Is Bitcoin the only legal currency in El Salvador?

No, Bitcoin functions as legal tender alongside the US dollar. The US dollar has been El Salvador’s official currency since 2001. Both currencies are officially recognized, though the dollar is more dominant in transactions.

Are businesses in El Salvador required to accept Bitcoin?

Businesses must accept Bitcoin if they can technologically. Exceptions apply to those without the necessary technology, mainly in rural areas. Enforcement has been inconsistent, with many businesses preferring dollar transactions.

What is the Chivo wallet?

The Chivo wallet is a digital wallet for Bitcoin adoption in El Salvador. It allows transactions in Bitcoin and US dollars. It includes Lightning Network for faster transactions and was designed to integrate with the financial system. The government offered a $30 Bitcoin incentive for users.

Has Bitcoin adoption been successful in El Salvador?

Bitcoin adoption in El Salvador has seen mixed results. The government reports some successes, like increased tourism and economic growth. Yet, independent studies show declining usage rates and most remittances still use traditional channels. Citizens generally prefer using US dollars.

What is Bitcoin City?

Bitcoin City is a planned urban development at the Conchagua volcano base. It aims to be a tax-free zone powered by geothermal energy for Bitcoin mining. The project was to be financed through “Volcano Bonds,” but has faced delays.

How has Bitcoin’s price volatility affected El Salvador?

Bitcoin’s volatility has posed significant challenges for El Salvador’s finances. The government’s Bitcoin holdings have seen dramatic value changes. President Bukele’s “buy the dip” strategy has complicated treasury management and raised fiscal stability concerns.

How have international financial institutions responded to El Salvador’s Bitcoin adoption?

International financial institutions have expressed concerns. The IMF and World Bank worry about financial stability risks and transparency. These concerns have affected El Salvador’s relationship with these institutions and its credit rating.

How have Salvadoran citizens responded to Bitcoin adoption?

Citizens have shown significant skepticism. Polls indicate confusion and preference for the US dollar. Protests against the Bitcoin adoption have been widespread. Support is mainly from younger, tech-savvy Salvadorans and communities with cryptocurrency experience.

What regulatory issues has El Salvador faced with Bitcoin adoption?

El Salvador has faced regulatory challenges. Concerns about anti-money laundering compliance and international pressure have arisen. The government has implemented some solutions, but transparency concerns persist.

How has Bitcoin adoption affected El Salvador’s economy?

The economic impacts of Bitcoin adoption are mixed. El Salvador experienced GDP growth, but attributing it to Bitcoin is challenging. Tourism has seen benefits, but remittances have not transformed as expected. The overall impact remains debated.