- Toncoin rose to the top as the coin with the highest social and market activity in the last 24 hours

- Worth evaluating whether these findings can influence TON’s short-term or long-term bullish prospects

Could Toncoin be on the verge on an interesting phase of adoption and robust growth over the next few months? Well, the altcoin gained significant popularity in 2024 courtesy of TON’s heavy focus on play-to-earn games. However, things have cooled down on that front since. And yet, the latest set of datasets seemed to suggest that potential excitement may be building up once again.

According to LunarCrush Social Intelligence, Toncoin is at the end of much renewed interest lately. This assertion was supported by the fact that at press time, it was the highest ranked cryptocurrency in terms of social and market activity in the last 24 hours.

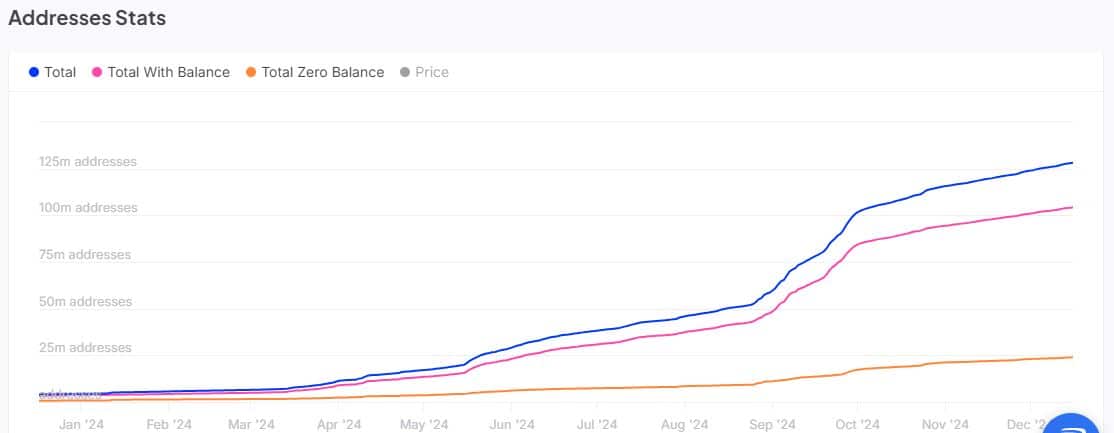

A surge in social activity often signals growing or renewed interest. However, will this observation also point towards growing demand for Toncoin? Well, according to CryptoQuant, TON addresses have been on a positive growth trajectory in the last 12 months.

For context, the network had 4.37 million addresses in January 2024. Roughly 3.6 million of those addresses had a balance and the remaining were zero-balance addresses. CryptoQuant found that these addresses have since grown to 128.17 million, as per the latest data.

TON grew to 104.24 million addresses with a balance and 23.93 million addresses with zero balance. This observation confirmed rising long term demand for Toncoin. However, this does not indicate any correlation with the surging social sentiment.

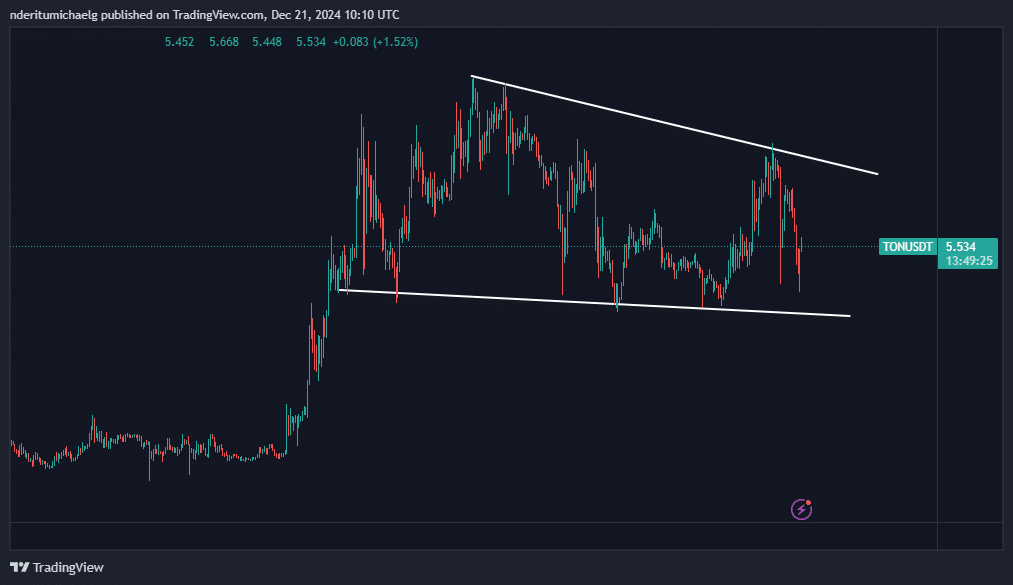

Short-term price action does, however, demonstrate some correlation. For example, the price bounced back over the last 2 days after an overall bearish week. Toncoin fell by 26% from its weekly high to a weekly low on Friday.

The cryptocurrency bottomed out at $4.77 on Friday, followed by a 15% rally to its $5.52 press time price level. This was in line with the social sentiment spike.

Toncoin has also been trading in a long term bullish flag pattern for the last 6 months. This suggested that a long term bullish breakout could be on the cards in 2025.

Some notable observations that could influence short term price action include a decline in spot outflows since mid-December. This could pave the way for positive flows. This seemed to correlate with a shift from negative to positive weighted funding rates during the last 24 hours.

This also confirmed that the latest sell pressure has attracted a sentiment shift in favor of accumulation after the discount.

The shift was also backed by growing volumes in the derivatives segment. TON’s volume amounted to $151.33 million on 15 December, withe the same climbing to $476.66 million within the last 24 hours.

Source: Coinglass

Sustained robust volumes may aid in more recovery in the coming days. The bulls are likely to be more dominant if renewed social activity attracts enough buying pressure.